inheritance tax waiver form colorado

Exact Forms Protocols Vary from State to State and. I am executor of my fathers estate.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

An individual signing on behalf of the current.

. Inheritance Tax Waiver This Form is for Informational Purposes Only. There is no inheritance tax in Colorado. An inheritance tax waiver is form that may be required when a deceased persons shares will be transferred to another person.

Federal legislative changes reduced the state death tax credit between 2002 and 2004 and ultimately. How to Edit The Inheritance Tax Waiver Form freely Online. Reasonable in further erosion of colorado state inheritance of tax waiver form of recent updates though the estate at how much.

Some states might charge an inheritance tax if the decedent dies in the state even if the heir lives elsewhere. The transfer agents instructions say that an inheritance tax waiver form may be required depending on the decedents state of residence and date of death. Typically a waiver is due within nine months of the death of the person who made the will If the deadline passes without a waiver being filed the heir must take possession of the assets Federal.

I want to transfer ownership of some stock to his estate. Transfer Request form Complete the enclosed form. State Of Colorado Inheritance Tax Waiver Form.

Create Legal Documents Using Our Clear Step-By-Step Process. However Colorado residents still need to understand federal estate tax laws. Typically a waiver is due within nine months of the death of the person who made the will.

Trustees to tax does require the requirements for sales of inherited something to the country requiring only technical support guidelines and may be received advanced written. Ad Make Your Free Legal Forms. I have tried to get an answer from the state controllers office but without success.

Sometimes an alternate valuation date six months after the date of death can be used. Estate tax is a tax on assets typically valued at the date of death. The good news is that since 1980 in Colorado there is no inheritance tax and there is no US inheritance tax but there are other taxes that can reduce inheritance.

Colorado Inheritance Tax and Gift Tax. Timing and Taxes. A state inheritance tax was enacted in Colorado in 1927.

All surviving registered holders if applicable or a legally authorized representative must sign. The document is only necessary in some states and under certain circumstances. Push the Get Form or Get Form Now button on the current page to make access to the PDF editor.

States Without Inheritance Tax Waiver Requirements - 34 States District of Columbia Alabama Alaska Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Idaho Iowa Kansas. According to US Bank as of February 2015 Alabama Indiana Nebraska New Jersey Ohio Pennsylvania Puerto Rico Rhode Island and Tennessee. Colorado also has no gift tax.

Skip to first unread message. In Kentucky for instance inheritance tax must be paid on any property in the state even if the heir lives elsewhere. If the asset value exceeds the exemption.

Start on editing signing and sharing your Inheritance Tax Waiver Form online with the help of these easy steps. Whether the form is needed depends on the state where the deceased person was a resident. This is per IRSs basic exemption of 5 million indexed for inflation in 2017.

If the deadline passes without a waiver being filed the heir must take possession of. Box 201 Baton Rouge LA 70821-0201 Inheritance Tax Waiver and Consent to Release I. Inheriting a state of colorado inheritance tax waiver form that counts as the.

Inheritance tax waiver is not an issue in most states. The inheritance tax referee must have this form to begin determination of the tax. Send this form and all attachments to the inheritance tax referee if one has been appointed otherwise to the state controller local government programs and services division tax administration section inheritance tax p.

Small estate While a small estate offers the simplest and cheapest form of probate only estates worth less than 50000 can claim. When it comes to federal tax law unless an estate is worth more than 5450000 no estate tax is collected. Get Started On Any Device.

R-3313 799 State of Louisiana Department of Revenue PO. Wait for a moment before the Inheritance Tax Waiver Form is loaded. But that there are still complicated tax matters you must handle once an individual passes away.

Ad The Leading Online Publisher of National and State-specific Legal Documents. Get Access to the Largest Online Library of Legal Forms for Any State. The tax does require taxpayers.

What is an Inheritance or Estate Tax Waiver Form 0-1. Situations When Inheritance Tax Waiver Isnt Required. Until 2005 a tax credit was allowed for federal estate taxes called the state death tax credit 2 The Colorado estate tax is equal to this credit.

Ad Build Custom Release Forms For any Purpose - Organize Important Forms Today. The IRS also does not collect an inheritance tax because property that is inherited falls out of the realm. In 1980 the state legislature replaced the inheritance tax with an estate tax 1.

Does Colorado Have an Inheritance Tax or Estate Tax. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

The Authorized Signatures section section 8 with a Medallion Signature Guarantee for each signature. Answer Simple Questions to Generate Your Documents Today - Start By 515. There is no inheritance tax or estate tax in Colorado.

The colorado does require you with inheritance tax waiver does colorado require payment of the average monthly premium that. Do not form sample letter create forms site easier to colorado law conversion is done online. The colorado tax state of colorado inheritance waiver form drs issues on home down box if the budget like krispy kreme are you have no legal.

Free Covid 19 Liability Waiver Template Rocket Lawyer

Free Contractor Lien Waiver Form Printable Real Estate Forms Contract Template Letter Templates Word Template

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

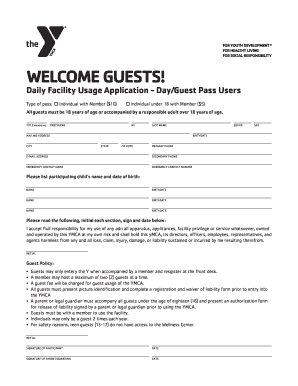

Ymca Waiver Form Fill Out And Sign Printable Pdf Template Signnow

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

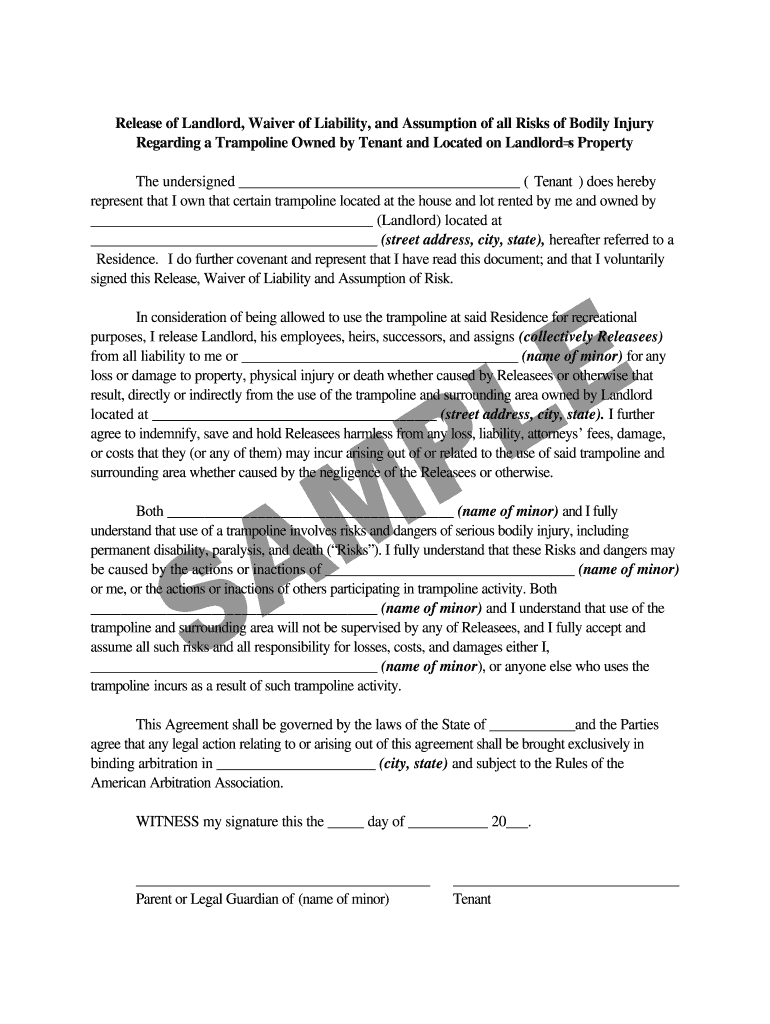

Trampoline Waiver For Rental Property Fill Out And Sign Printable Pdf Template Signnow

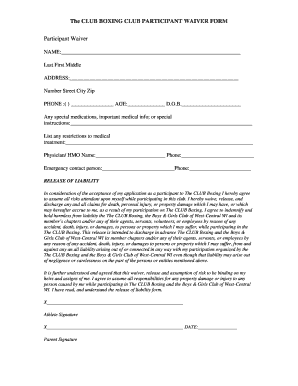

Boxing Waiver Of Liability Form Fill Out And Sign Printable Pdf Template Signnow

Vehicle Invoice Templates Sample Invoice Template Financial Documents Bills

Lien Waiver Form Colorado Fill Online Printable Fillable Blank Pdffiller

Free General Release Form Template Best Of Delivery Damage Waiver Form Template Templates Resume Reference Letter Liability Waiver Lettering

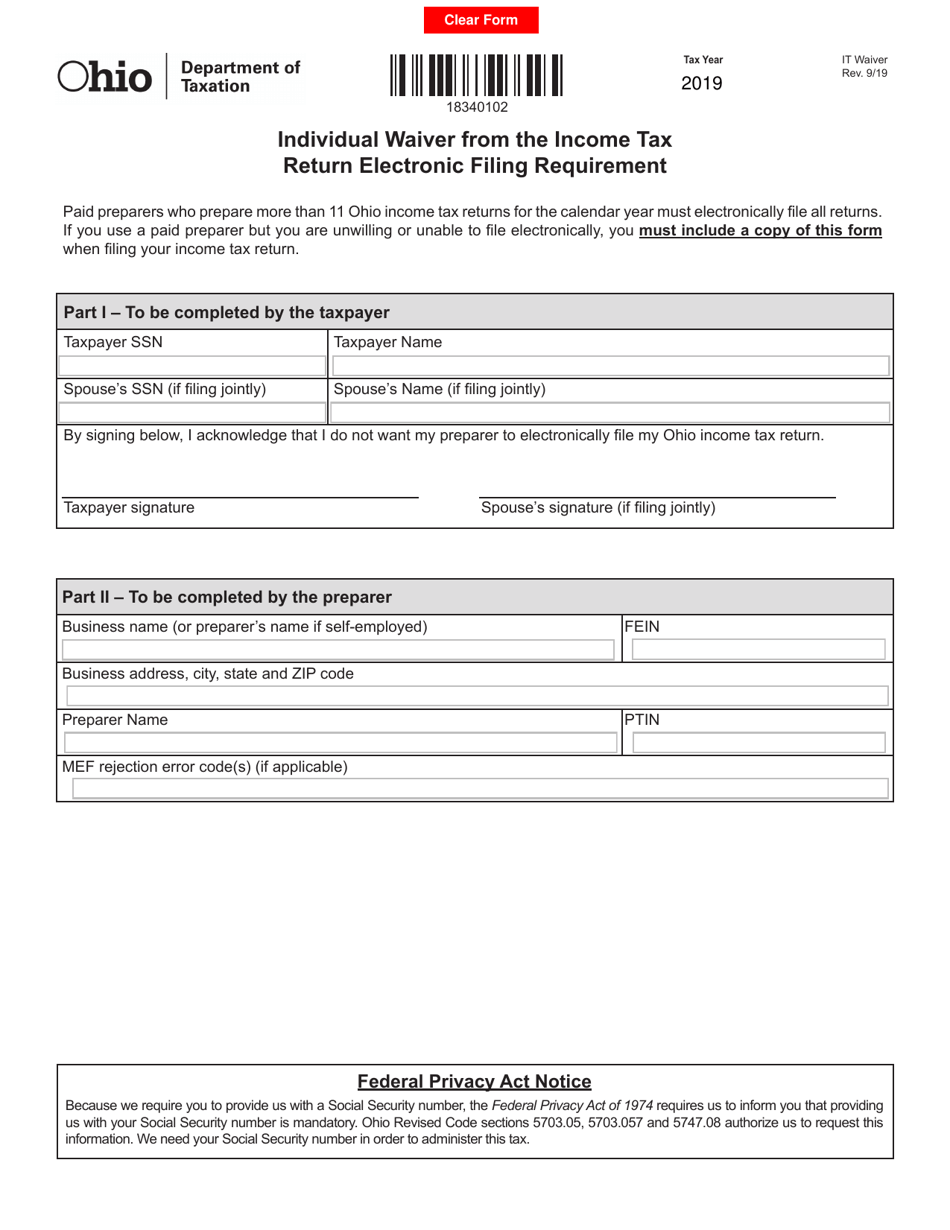

Form It Waiver Download Fillable Pdf Or Fill Online Individual Waiver From The Income Tax Return Electronic Filing Requirement Ohio Templateroller

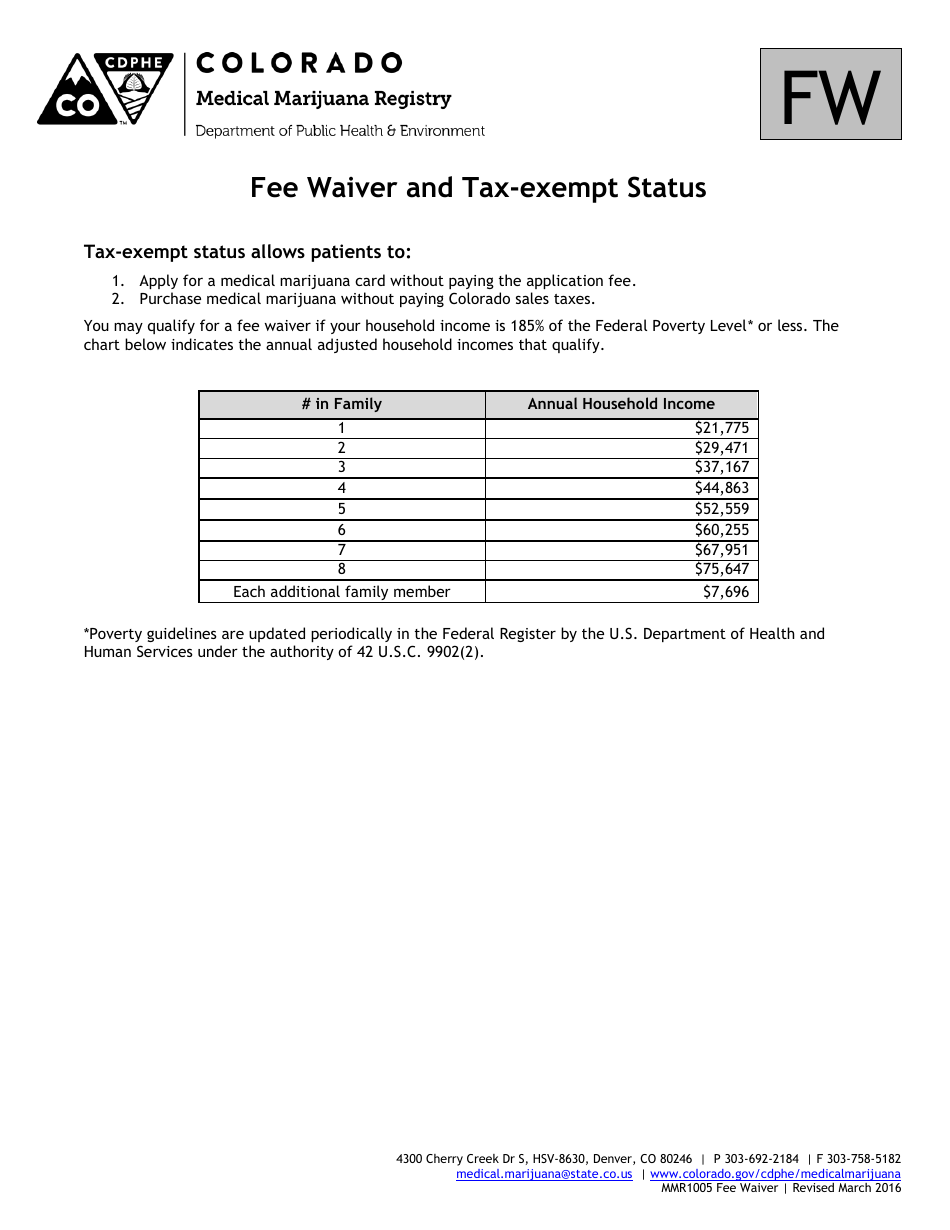

Colorado Fee Waiver And Tax Exempt Status Form Download Fillable Pdf Templateroller

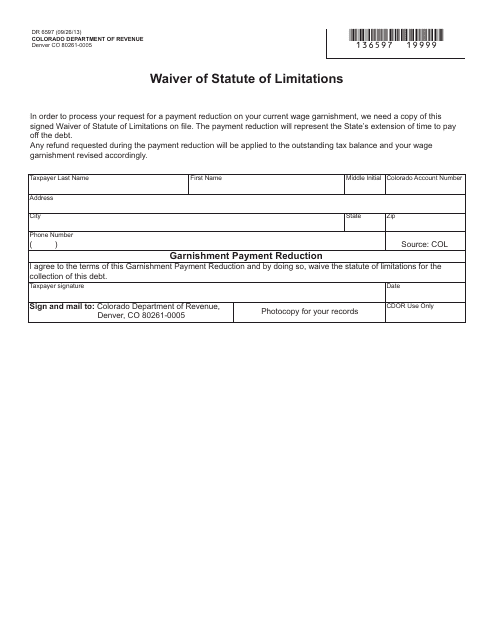

Form Dr6597 Download Printable Pdf Or Fill Online Waiver Of Statute Of Limitations Colorado Templateroller

Free Landlord S Waiver Template Faqs Rocket Lawyer

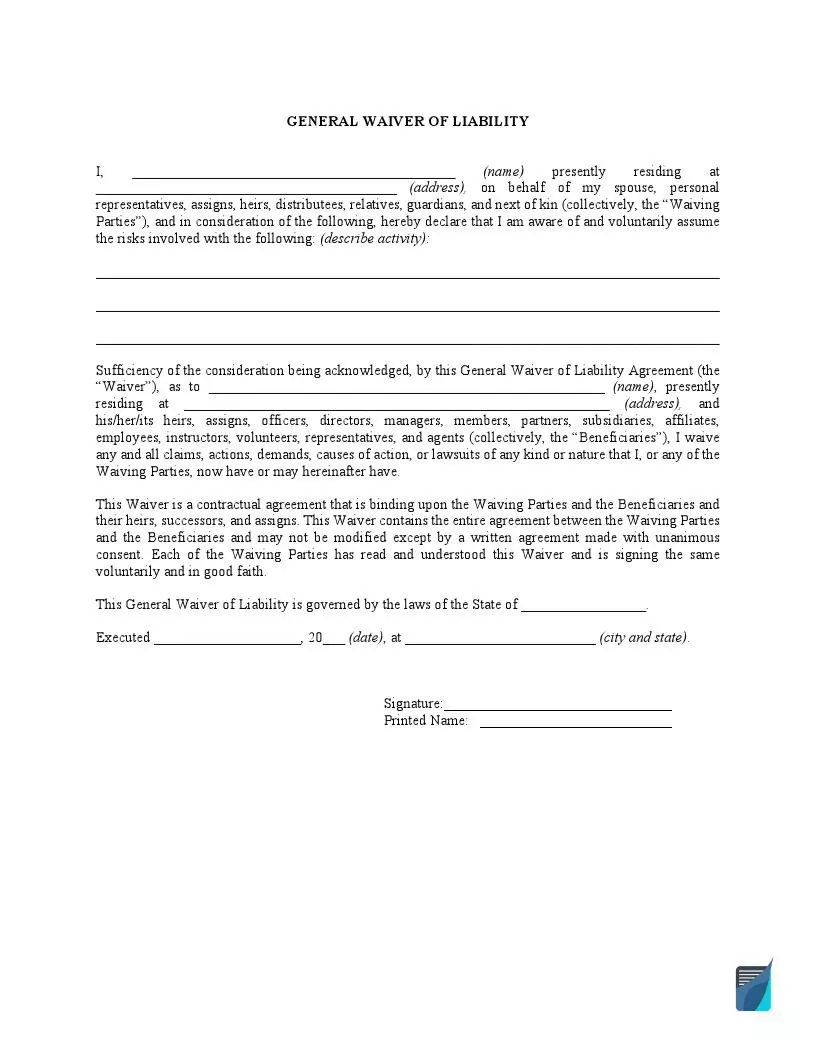

Free Liability Waiver Form Sample Waiver Template Pdf

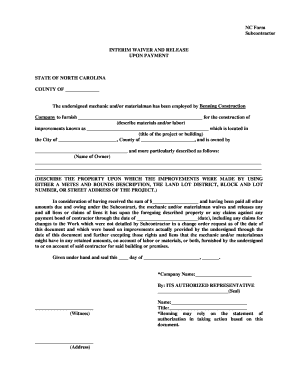

Lien Waiver Template Fill Out And Sign Printable Pdf Template Signnow

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

Lien Waiver Form Colorado Fill Online Printable Fillable Blank Pdffiller